As a salon owner, you know that a smooth and effortless payment process is an important part of making your customers happy. However, with the convenience of accepting credit cards comes the risk of security and data breaches and identity theft.

That’s where the Payment Card Industry Data Security Standard (PCI DSS) comes into play.

It’s crucial to your salon’s success that you know how to become PCI compliant as a small business. In this article, we’ll discuss the PCI compliance requirements and levels laid out in the PCI DSS. We’ll also talk about why it’s important to follow these requirements and how to stay compliant and protect cardholder data.

Let’s dive in!

What Are PCI Compliance Requirements?

The PCI requirements are a set of guidelines created by the PCI Security Standards Council to make sure that businesses are safeguarding sensitive cardholder data from fraud and misuse. These guidelines cover everything from network security measures to employee training on payment security best practices.

If you’re a business owner and handle financial information, it’s important to become familiar with PCI compliance requirements. Remaining compliant reduces your risk of data breaches, protecting both you and your guests.

What Are the 4 Compliance Levels?

The PCI DSS categorizes small businesses based on the number and volume of credit card transactions they process each year.

There are 4 levels of PCI DSS compliance:

- Level 1: Over 6 million card transactions per year

- Level 2: Between 1-6 million card transactions per year

- Level 3: Between 20,000 to 1 million card transactions per year

- Level 4: Fewer than 20,000 card transactions per year

Small salons typically fall into Level 4 because they process less than 20,000 transactions annually. Knowing your merchant level can help you understand the specific PCI compliance requirements you need to meet to avoid data breaches, costly fines, and headaches.

Processing transactions also has regulatory requirements that vary depending on whether the transaction is mail order, e-commerce, point of sale, or a combination.

Why Is PCI DSS Compliance Important for Salons?

PCI compliance is necessary for any business that accepts credit card payments, regardless of its size. Non-compliance can lead to hefty fines, damage to your reputation, and even legal action.

The cost to repair the damage caused by a data breach can be catastrophic for a small salon business like yours. By adhering to PCI standards, you’re protecting both your clients and your salon.

How to Become PCI Compliant as a Small Business

The PCI DSS consists of 12 fundamental requirements aimed at safeguarding sensitive cardholder data, no matter where it’s transmitted or stored.

PCI compliance requirements

PCI compliance requires salons to do the following:

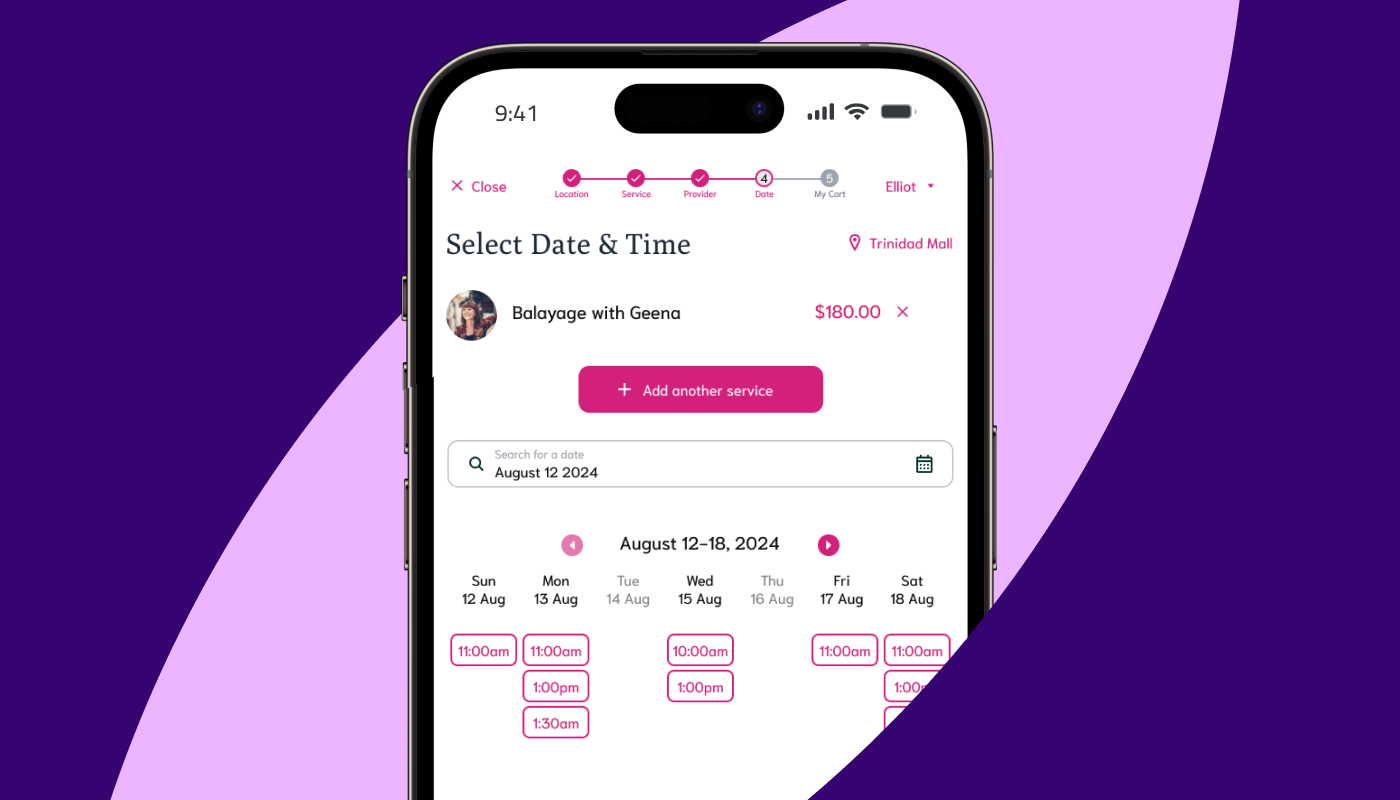

1. Only use a PCI-Compliant Service Provider or PCI-Approved Software (such as SalonBiz Payments) when processing credit card payments.

2. Do not store the card security code. The security code is the three-digit number on the back of Visa/MasterCard/Discover cards, or the four-digit number on the front of American Express cards.

3. The magnetic track data from any card should never be stored.

4. Full credit and debit card numbers in any electronic storage should be encrypted.

5. When not in use, keep paper documents containing a complete credit card number in a secure location (such as a locked file drawer or safe).

6. Credit card numbers should only be accessible to employees with legitimate business needs.

7. Never share user IDs and passwords or the use of group user accounts.

8. Strong passwords, with at least 7+ alpha-numeric characters, should be used for all system access.

9. All terminated employees’ access should be immediately disabled.

10. Regularly examine all POS swipe devices for signs of tampering and ensure their security.

11. Install and activate personal firewalls and anti-virus/anti-malware software and disable all generic or default user accounts and passwords on all business computers to secure them.

12. Create a security policy for your business that covers all aspects of the PCI DSS.

Self-Assessment Questionnaire (SAQ)

After integrating a payment processing partner and implementing your salon’s security policy, visit the PCI website, where you can find a certification form to complete.

If you process transactions online, by mail, or by phone, you can use Self-Assessment Questionnaire A (SAQ-A). If you also process retail transactions, you will need to complete the SAQ-B survey.

Submit the survey to your merchant processing company to fulfill your annual PCI compliance requirements. Always keep a copy of the survey to ensure continuous compliance.

How Can I Add PCI Compliance to My Daily Salon Operations?

Incorporating PCI compliance best practices into your daily salon business operations means setting up a comprehensive strategy that prevents data breaches and keeps client payment card data secure.

Here are some ways you can demonstrate your salon’s commitment to PCI Compliance:

- Make sure that your payment processing system and security systems meet PCI Compliance standards and keep your business certification updated.

- Use a secure webpage to collect clients’ credit card details and other payment data. Always check for the lock icon and “https” in the browser bar.

- Never store CVV security codes after processing telephone or online payments.

- Let your guests know to never send sensitive data like credit card or bank account numbers via email. You can even include a security notice in the footer of your emails to raise awareness.

Stay PCI Compliant with SalonBiz Salon Management Software

Are you feeling slightly intimidated by the idea of maintaining PCI DSS compliance? Don’t worry, we’ve got your back.

SalonBiz is here to help ensure that your business is always in the clear.

From secure payment processing to encryption of customer and payment card data, our software takes care of the heavy lifting so you can focus on what you do best—making your clients look and feel fabulous!

Say goodbye to the stress of keeping up with ever-changing compliance regulations and give yourself peace of mind with SalonBiz. Schedule a demo today!